The Single Strategy To Use For Annuities In Toccoa, Ga

Table of ContentsAutomobile Insurance In Toccoa, Ga Can Be Fun For AnyoneThe 30-Second Trick For Insurance In Toccoa, GaGetting The Affordable Care Act (Aca) In Toccoa, Ga To WorkThe Single Strategy To Use For Automobile Insurance In Toccoa, GaNot known Details About Home Owners Insurance In Toccoa, Ga The Single Strategy To Use For Insurance In Toccoa, Ga

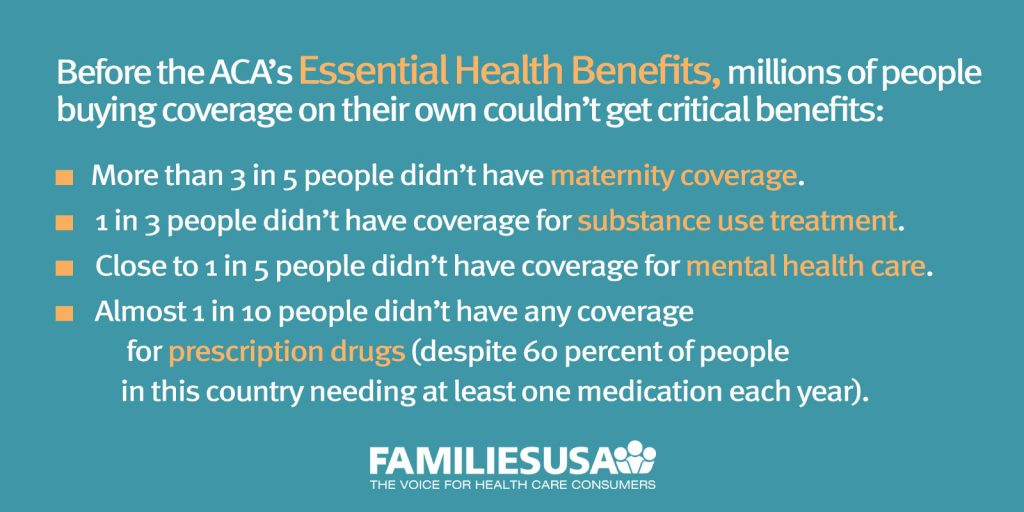

Find out just how the Affordable Care Act(Obamacare)enhanced specific health and wellness insurance coverage and provided strategy cost with aids, Medicaid expansion and other ACA arrangements. These alternatives can consist of clinical, dental, vision, and much more. Find out if you are qualified for insurance coverage and enlist in a strategy with the Marketplace. See if you are qualified to make use of the Health and wellness Insurance policy Industry. There is no revenue limit. To be eligible to register in health and wellness coverage through the Marketplace, you: Under the Affordable Treatment Act(ACA), you have special person defense when you are insured with the Medical insurance Industry: Insurers can not refuse protection based upon sex or a pre-existing condition (Annuities in Toccoa, GA). https://teleadreson.com/thomas-insurance-advisors,194-remsdale-st,-toccoa,-ga-30577,-united-states-VzSSAFc0kgA.html. The health treatment legislation offers legal rights and defenses that make protection extra reasonable and understandable. Some legal rights and protections use to plans in the Medical insurance Marketplace or other private insurance coverage, some use to job-based strategies, and some put on all health insurance coverage. The securities detailed listed below might not use to grandfathered health insurance prepares.With clinical costs rising, the requirement for personal wellness insurance policy in this day and age is a financial reality for lots of. Health insurance is the primary vehicle that many customers use to pay for medical and health center expenses. There is public health insurance policy such as Medicare and Medicaid, which some might receive relying on age, earnings and family members size. Within the classification of exclusive

medical insurance, there are substantial differences in between a health managed organization (HMO)and a recommended company organization(PPO)strategy. Relying on the kind of exclusive medical insurance you select, there will be certain benefits and constraints. While the majority of financial planners will urge you to carry a type of exclusive insurance coverage, it can feature some disadvantages that should be considered when you purchase a plan. In this way, care is worked with via your PCP.When taking into consideration if an HMO is ideal for you, right here are some things to think about: HMOs usually set you back much less than PPOs. An HMO may be a good option if you don't have lots of health issue and as a result little requirement to check out professionals and/or if you don't mind coordinating treatment with your PCP. A PPO consists of a network of doctor with both primary care and specialists

PPOs provide greater versatility than HMOs due to the fact that a referral is not called for to see a professional. You may also see providers out of network, though you will certainly need to pay higher copays to do so. Bear in mind the following when making a decision if a PPO is the very best option for you. PPOs are typically extra pricey than HMOs. PPOs may offer even more flexibility if you locate on your own seeking specialists 'treatment or already have medical professionals that you desire to see, even if they are not in-network. Obviously, the most noticeable advantage is that exclusive medical insurance can offer insurance coverage for some of your medical care expenses. This can enable you to pick the options that you are probably to require and omit those that you do not

. The experiences that come with personal medical insurance might consist of much shorter wait times, higher personalized interest and extra advanced centers. Public facilities can be jammed sometimes and may supply a reduced level of treatment in many situations. This is particularly real if you are in bad wellness and do not have access to group protection of any kind of kind.

10 Easy Facts About Insurance In Toccoa, Ga Shown

Lots of specific policies can set you back numerous hundred dollars a month, and family protection can be also greater. And even the much more thorough plans featured deductibles and copays that insureds must satisfy before their coverage begins.

Most wellness plans must cover a collection of preventive solutions like shots and screening tests at no expense to you. https://sandbox.zenodo.org/records/25112. This includes strategies readily available via the Health Insurance Industry.

A Biased View of Annuities In Toccoa, Ga

When you get insurance, the regular monthly costs from your insurer is called a premium. Insurance provider can no much longer bill you a greater premium based on your wellness status or because of pre-existing clinical conditions. Insurance business supplying significant medical/comprehensive plans, established a base rate for everybody who gets a health and wellness insurance coverage strategy and after that readjust that rate based on the elements listed here.

Typically, there is a tradeoff in the costs quantity and the expenses you pay when you receive care. The higher the regular monthly costs, the reduced the out-of-pocket prices when you get treatment.

For even more details on sorts of medical insurance, call your employer advantage agent or your economic expert. In recap, here are some of the advantages and disadvantages of making use of exclusive health insurance coverage. Pros Multiple options so you can choose the finest plan to satisfy your individual needs Generally supplies better adaptability and accessibility to care than public wellness insurance coverage Can cover the price of costly treatment that may arise all of a sudden Cons Costly with premiums climbing yearly Does not ensure total accessibility to care If you want to find out more regarding saving for medical care or how medical care can affect your household budget, check out the Safety Understanding Facility.

9 Simple Techniques For Final Expense In Toccoa, Ga

The majority of wellness strategies need to cover a set of preventive services like shots and screening tests at no price to you. This consists of plans available through the Medical insurance Industry. Notification: These services are cost-free just when provided by a doctor or various other copyright in your strategy's network. There are 3 sets of cost-free preventative services.

When you acquire insurance coverage, the regular monthly bill from your insurance policy business is called a costs. Insurance provider can no more charge you a greater premium based on your wellness condition or as a result of pre-existing medical problems. Insurer supplying major medical/comprehensive policies, established a base rate for everybody who buys a medical insurance plan and afterwards readjust that rate based on the variables noted below.

Generally, there is a tradeoff in the premium amount and the prices you pay when you receive care. The higher the month-to-month premium, the lower the out-of-pocket expenses when you obtain treatment.

All about Medicare/ Medicaid In Toccoa, Ga

Many health and wellness strategies need to cover a collection of preventative solutions like shots and testing examinations at no price to you. This consists of plans readily available via the Wellness Insurance Coverage Industry.

When you get insurance coverage, the regular monthly bill from your insurance provider is called a costs. Insurer can no more bill you a higher costs based on your health standing or because of pre-existing medical problems. Insurance coverage companies using significant medical/comprehensive policies, established a base price for everyone that gets a medical insurance strategy and afterwards readjust that rate based upon the elements provided below.

Automobile Insurance In Toccoa, Ga Things To Know Before You Get This

Normally, there is a tradeoff in the costs amount and the costs you pay when you receive care - Home Owners Insurance in Toccoa, GA. The higher the monthly costs, the lower the out-of-pocket costs when you obtain care